Tax professionals

Tax professional Resources

Assist your client online

Access your client's information

Learn about your responsibilities

Find what you're looking for

Important Information

Reminder: How to report pass-through entity taxes on Form IT-112-R, New York State Resident Credit

We recently sent an email about taxpayers and tax practitioners incorrectly reporting pass-through entity tax payments on lines 24a and 24b of Form IT-112-R. To learn more:

Coming soon—updated estate tax forms

To improve user experience and reduce errors, we're redesigning and developing fill-in forms for our most frequently used estate tax forms.

To stay up to date regarding the changes:

Additional Tools

Plan Ahead

Pay your client's bill or notice

You can make a payment or request a payment plan for your client using one of our convenient online options.

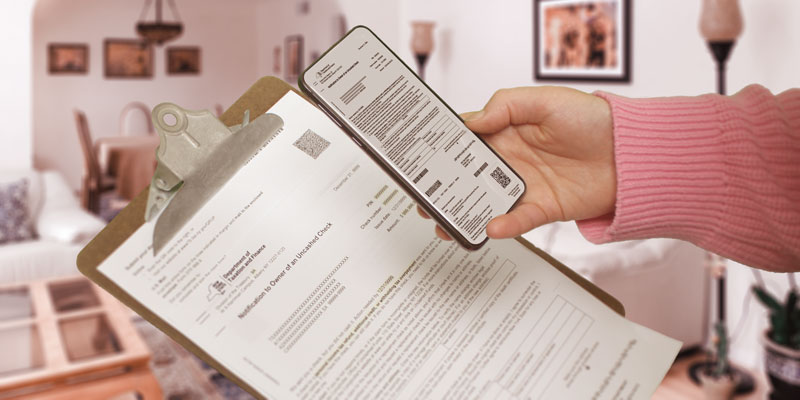

Learn what we're mailing

Did your client receive a letter, bill, notice, or check? Visit our new letter resource center for the latest information on what we're mailing.

Updated: